1099-r box 7 distribution code 6 If a rollover contribution is made to a traditional or Roth IRA that is later revoked or closed, and distribution is made to the taxpayer, enter in boxes 1 and 2a of Form 1099-R the gross . 40 Travel Sheet Metal jobs available on Indeed.com. Apply to Welder, Sheet Metal Mechanic, Crew Member and more!

0 · irs distribution code 7 meaning

1 · irs 1099 box 7 codes

2 · form 1099 box 7 codes

3 · 1099 r minimum reporting amount

4 · 1099 r distribution codes 7d

5 · 1099 r distribution code meanings

6 · 1099 r code 7 means

7 · 1099 codes explained

Ametco Manufacturing Corporation manufactures custom Swing gates, V-wheel roller gates and Cantilever gates to complete your enclosure. All three style gates are made for trash enclosures in either galvanized steel or aluminum that after fabrication are .

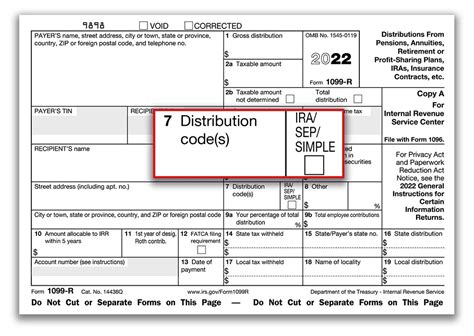

The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty.Code 6 is a "Section 1035 tax-free exchange." Section 1035 is a financial .

If a rollover contribution is made to a traditional or Roth IRA that is later revoked or closed, and distribution is made to the taxpayer, enter in boxes 1 and 2a of Form 1099-R the gross .1099-R. Report military retirement pay awarded as a property settlement to a former spouse under the name and TIN of the recipient, not that of the military retiree. Use Code 7 in box 7 . Use Code 6 to indicate the tax-free exchange of life insurance, annuity, long-term .

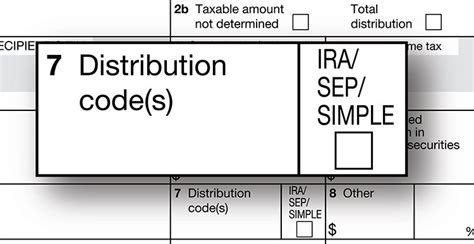

One of the most difficult aspects of reporting IRA and QRP distributions is determining the proper distribution code (s) to enter in Box 7, Distribution code (s) on IRS Form 1099-R, Distributions From Pensions, .Are you filing a Form 1099-R for your client? Find the explanation for box 7 codes here.Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. Early distribution, no known exception (in most cases, .

7 (Normal Distribution) B (Designated Roth) Code P: Corrective refunds taxable in prior year: This code indicates the monies are taxable in a prior tax year (as opposed to Code . Code 6 is a "Section 1035 tax-free exchange." Section 1035 is a financial transaction in which a life insurance or annuity policy is replaced for a new one without any taxable event . Form 1099-R Distribution Codes from Box 7. Detailed explanation. The Distribution Code Table below refers to the entries on Form 1099 in Box 7. Detailed overview, instructions .

The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty.

irs distribution code 7 meaning

If a rollover contribution is made to a traditional or Roth IRA that is later revoked or closed, and distribution is made to the taxpayer, enter in boxes 1 and 2a of Form 1099-R the gross distribution and the appropriate code in box 7 (Code J for a Roth IRA).1099-R. Report military retirement pay awarded as a property settlement to a former spouse under the name and TIN of the recipient, not that of the military retiree. Use Code 7 in box 7 for reporting military pensions or survivor benefit annuities. Use Code 4 for reporting death benefits paid to a survivor beneficiary on a separate Form 1099-R.Use Code 6 to indicate the tax-free exchange of life insurance, annuity, long-term care insurance, or endowment contracts under section 1035. One of the most difficult aspects of reporting IRA and QRP distributions is determining the proper distribution code (s) to enter in Box 7, Distribution code (s) on IRS Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc.

Are you filing a Form 1099-R for your client? Find the explanation for box 7 codes here.Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. Early distribution, no known exception (in most cases, under age 59½). Early distribution, exception applies (under age 59½).

7 (Normal Distribution) B (Designated Roth) Code P: Corrective refunds taxable in prior year: This code indicates the monies are taxable in a prior tax year (as opposed to Code 8 with the distribution taxable the year of the 1099-R form). 1 (Early Distribution) 2 (Early Distribution—not subject to 10% early distribution tax) 4 (Death) B .

Code 6 is a "Section 1035 tax-free exchange." Section 1035 is a financial transaction in which a life insurance or annuity policy is replaced for a new one without any taxable event (Basically, it just means replacing one annuity contract . Form 1099-R Distribution Codes from Box 7. Detailed explanation. The Distribution Code Table below refers to the entries on Form 1099 in Box 7. Detailed overview, instructions of Form 1099-R and 5498. Participant has not reached age 59 1/2, and there are no known exceptions under Code 2, 3, or 4 apply.The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty.If a rollover contribution is made to a traditional or Roth IRA that is later revoked or closed, and distribution is made to the taxpayer, enter in boxes 1 and 2a of Form 1099-R the gross distribution and the appropriate code in box 7 (Code J for a Roth IRA).

1099-R. Report military retirement pay awarded as a property settlement to a former spouse under the name and TIN of the recipient, not that of the military retiree. Use Code 7 in box 7 for reporting military pensions or survivor benefit annuities. Use Code 4 for reporting death benefits paid to a survivor beneficiary on a separate Form 1099-R.Use Code 6 to indicate the tax-free exchange of life insurance, annuity, long-term care insurance, or endowment contracts under section 1035. One of the most difficult aspects of reporting IRA and QRP distributions is determining the proper distribution code (s) to enter in Box 7, Distribution code (s) on IRS Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc.Are you filing a Form 1099-R for your client? Find the explanation for box 7 codes here.

Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. Early distribution, no known exception (in most cases, under age 59½). Early distribution, exception applies (under age 59½). 7 (Normal Distribution) B (Designated Roth) Code P: Corrective refunds taxable in prior year: This code indicates the monies are taxable in a prior tax year (as opposed to Code 8 with the distribution taxable the year of the 1099-R form). 1 (Early Distribution) 2 (Early Distribution—not subject to 10% early distribution tax) 4 (Death) B .

Code 6 is a "Section 1035 tax-free exchange." Section 1035 is a financial transaction in which a life insurance or annuity policy is replaced for a new one without any taxable event (Basically, it just means replacing one annuity contract .

irs 1099 box 7 codes

TMR’s report on the global metal fabrication market studies the past as well as the current growth trends and opportunities to gain valuable insights of the indicators of the market during the forecast period from 2022 to 2031.

1099-r box 7 distribution code 6|form 1099 box 7 codes