what is non dividend distribution box 3 The answer to your question is that a nondividend distribution (one, or more, it doesn't matter) actually won't affect your taxes at all this year and won't directly appear . Unusual Wooden CIGAR Box metal strap Red Lion York Co Pa HINGED, MARKED NO. 411 .D-Box (Power Distribution) allows for user selectable power outputs including 2pin, 4pin, 4pin Hirose, 3pin Fischer, D-Tap, and USB. Allows for up to 6 simultaneous outputs with a .

0 · non dividend distributions 1040

1 · non dividend distributions

2 · non dividend distribution reporting

3 · non dividend distribution form

4 · box 3 non dividend distributions

5 · best non dividend distributions

6 · 1099 box 3 nondivided distribution

7 · 1099 box 3 non dividend

Our OZCO wood to steel fence brackets are the most sophisticated, complete bracket for building wood fences using steel posts. OZCO wood to steel brackets offer the best finish, predrilled holes, and ship complete with mounting hardware.

Form 1099-DIV Box 3. You can find your nontaxable distributions on Form 1099-DIV, Box 3. They’re uncommon. How to Calculate Nondividend Distributions. . Non dividend distributions do not go anywhere on your actual tax return. Box 3 is for your information. Box 3 is a "return of capital". That is, you have been given back part of . The answer to your question is that a nondividend distribution (one, or more, it doesn't matter) actually won't affect your taxes at all this year and won't directly appear . When you receive a Form 1099-DIV indicating non dividend distributions in Box 3, you should report this amount on your tax return. Consult the IRS guidelines and instructions for Form 1099-DIV to ensure accurate .

Any nondividend distribution is not taxable until the basis of the stock is recovered; however, a record needs to be maintained. After the basis of your stock is reduced to zero, the .A nondividend distribution is a distribution that is not paid out of the earnings and profits of a corporation or a mutual fund. You should receive a Form 1099-DIV or other statement showing .

Box 3: Non-Dividend Distributions. These are distribution in excess of the company’s earnings (including any retained earnings from previous years) and in excess of any realized capital. Non-taxable distributions are generally reported in Box 3 of Form 1099-DIV. Return of capital shows up under the “Non-Dividend Distributions” column on the form.

Nondividend distributions, reported in Box 3, represent a return of capital rather than income. These distributions are not immediately taxable; instead, they reduce your cost basis in the investment. Further distributions . Non-taxable distributions are generally reported in Box 3 of Form 1099-DIV. Return of capital shows up under the “Non-Dividend Distributions” column on the form.A nondividend distribution is a distribution that is not paid out of the earnings and profits of a corporation or a mutual fund. You should receive a Form 1099-DIV or other statement showing you the nondividend distribution. On Form 1099-DIV, a .

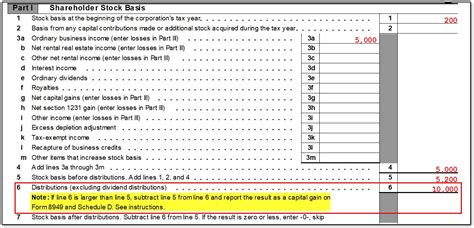

A nondividend distribution is a distribution that is not paid out of the earnings and profits of a corporation or a mutual fund. You should receive a Form 1099-DIV or other statement showing you the nondividend distribution. On Form 1099-DIV, a . A non-dividend distribution in an S Corporation occurs when the corporation distributes funds or assets to its shareholders beyond the scope of regular dividends. Understanding these distributions is crucial for shareholders and tax planning. . Non-taxable distributions are generally reported in Box 3 of Form 1099-DIV. Return of capital shows .It was distributed to you hence a non dividend distribution. It essentially defers the tax on the . Reply reply More replies More replies. Top 1% Rank by size . More posts you may like r/tax. r/tax. Reddit's home for tax geeks and taxpayers! News, discussion, policy, and law relating to any tax - U.S. and International, Federal, State, or local.

This was reported to me on Form 1099-DIV in box 3 (Nondividend distributions). These distributions are not treated the same as ordinary (Box 1a) or qualified dividends (Box 1b). . Non-dividend distribution Example An individual who is a citizen of the United States owns one share of Company A, Inc. stock. This share was purchased on December .