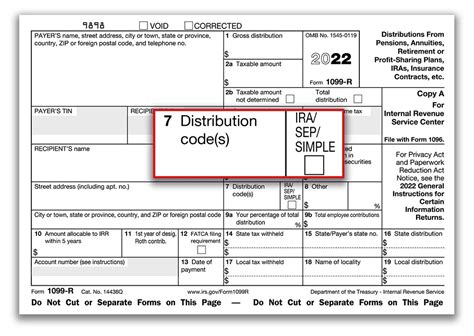

what is distribution code 2 in box 7 of 1099-r The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty. Automotive sheet is very thin. I would recommend either MIG welding but that requires a whole new set-up. If you have a torch, an oxy-acetylene weld with steel filler is a good choice. Choose one of the smaller torch welding tips for the job. I know they come with a number designation but most kits have 3.

0 · what does code 7d mean

1 · irs 1099 box 7 codes

2 · form 1099 box 7 codes

3 · distribution code 7 normal

4 · 1099r box 7 code 8

5 · 1099 r distribution code m2

6 · 1099 r distribution code e

7 · 1099 distribution code 7d

1199 Old Dixie Hwy, Riviera Beach, FL, 33404-7327. Complete contact info, phone number and all products for this location. Get a direct or competing quote.West Gate Sheet Metal Inc, 1199 Old Dixie Hwy, Riviera Beach, FL (Employees: Baugh, Alvin E, Bensch, Herbert, and Sterling Jonathan J) holds a Construction Business .

The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty.If a rollover contribution is made to a traditional or Roth IRA that is later revoked or closed, and distribution is made to the taxpayer, enter in boxes 1 and 2a of Form 1099-R the gross .

Use Code J, Early distribution from a Roth IRA, to report a Roth IRA distribution when the IRA owner is under age 59½ and codes Q and T do not apply. But use code 2 for an IRS levy and code 5 for a prohibited transaction. Distribution codes in Box 7 of Form 1099-R tell the IRS what type of distribution you received. These codes indicate if the distribution is subject to early withdrawal penalties, . L (Deemed Distribution from Loan) P (Taxable in prior year of the 1099-R year—the year the refunded contribution was made) Code 7: Normal distribution. The distribution is after . Which distribution code should your organization use in Box 7 of IRS Form 1099-R when reporting this distribution? Enter code G, Direct rollover and direct payment, when plan participants or IRA owners directly roll over .

The following are the instructions for the 1099-R, Box 7 data entry and what each code means. Codes. 8: Per IRS instructions, distributions with code. 8. that are not from an IRA, SEP, or .

1099-R Form Retirement Distribution Codes. The Distribution Code Table below refers to the entries on Form 1099 in Box 7. Detailed overview, instructions of Form 1099-R .

Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. In the follow-up to entering the code 2B Form 1099-R, you must indicate that the distribution is NOT from a Roth IRA. TurboTax needlessly asks this question which serves only as an opportunity to make a mistake in answering since code B already explicitly indicates that the distribution from a Designated Roth Account in a qualified retirement plan, not from a Roth IRA. The loan was satisfied by the offset distribution being reported with code M. Because an offset distribution is eligible for rollover, you can get the money back into a retirement account by rolling over (usually to a traditional IRA) some or all of the gross amount of the offset distribution by the due date of your 2018 tax return, including extensions.

@Anstoss . It is probably taxable because you failed to enter the other half of a "backdoor Roth". There are two parts: 1) enter the non-deductible contribution in the IRA contribution section and mark it non-deductible (assuming that this was a new 2019 contribution - if prior to 2019 then you should have a 8606 form form the prior years contribution in box 14).B and 2 are two separate codes and must be entered individually in the two drop-down boxes on TurboTax's 1099-R form. Codes B and 2 together mean that the distribution was from a Designated Roth Account in a qualified retirement plan (B) but is not subject to an early-distribution penalty despite you having been under age 59½ at the time of .

A common compliance mistake occurs when financial organizations use the incorrect distribution code in Box 7, Distribution code(s), on IRS Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc. IRA owners and qualified retirement plan (QRP) participants who take distributions during a given .

1099-R Codes for Box 7. Haga clic para español. Revised 01/2024. Box 7 Code. Description. Explanations . Use Code 7: (a) for a normal distribution from a plan, including a traditional IRA, section 401(k), or section 403(b) plan, if the employee/taxpayer is at least age 591/2; (b) for a Roth IRA conversion if the participant is at least age . Usually, you should see a code 7 in box 7 on your Form 1099-R. If the distribution is for your RMD for the year, it will be treated as a normal distribution. The code 7 will be marked in Box 7 on your Form 1099-R. Besides, it will also be reported on a Form 5498 "IRA Contribution Information" where box 11 and 12 will be checked .You are not .

One of the most difficult aspects of reporting IRA and qualified retirement plan (QRP) distributions is determining the proper distribution codes to enter in Box 7, Distribution code(s), on IRS Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc. Consider the following common IRA and QRP . In box 7 under distribution code it says 2B. I can choose 2 or B under the pull down menu, not both. which am I supposed to choose? . There are two boxes available in the box 7 area of the 1099-R screen. Select 2 for the first one and B for the second one. **Say "Thanks" by clicking the thumb icon in a post

I have a client that that has distribution code marked "2"on his 1099-R. He is 58 and retired from a company. . If the 1099-R worksheet was filled out correctly, the program should not even calculate a penalty with a code 2 in box 7. Are you trying to force a penalty? 3 Cheers Yadir. Level 3 02-18-2020 06:11 PM. Mark as New; Bookmark .1099-R Codes for Box 7. Haga clic para español. Revised 12/2022. Box 7 Code. Description. Explanations . Use Code 7: (a) for a normal distribution from a plan, including a traditional IRA, section 401(k), or section 403(b) plan, if the employee/taxpayer is at least age 591/2; (b) for a Roth IRA conversion if the participant is at least age .

what does code 7d mean

The amount shown in box 2a of this Form 1099-R is includible in income and subject early-distribution penalty on your 2017 tax return. If any amount is shown in box 4, this Form 1099-R is also reportable on your 2018 tax return because the tax withholding applies to . Defining 1099-R Codes. Your age dictates the 1099-R conversion code, which appears in box 7 “Distribution code(s).” If you have not yet reached age 59 1/2, your custodian will place a “2 . You use code 7 - Normal Distribution in box 7. There is not such code for 7 - Nondisability. That is something that OPM enters on the 1099-R and does not comply with the IRS approved codes for box 7. . When leaving 1099-R OPM box 2 blank it makes the customer get a higher refund. When box 2 is entered with box 1 info into TurboTax software it . What is distribution code "G" in box 7 on 1099-R? . if you skipped the traditional IRA rollover and converted it to the ROTH directly then you will need to use a code 7 in the box 7 of the 1099-R and NOT the code G. February 17, 2023 2:19 PM. 0 1 2,700 Reply. Bookmark Icon. dmertz. Level 15 Mark as New; Bookmark;

Distribution codes in Box 7 of Form 1099-R tell the IRS what type of distribution you received. These codes indicate if the distribution is subject to early withdrawal penalties, exempt from penalties, or rolled over into another . I agree, there should have been no code L1 2019 Form 1099-R since the loan was satisfied by the 2018 offset distribution reported on the code M1 2018 Form 1099-R and you had no loan in 2019 on which you could have defaulted in 2019. You need to obtain a corrected code L1 2019 Form 1099-R from the payer showing Then enter the letter B in the 2nd box drop down. Box 7 distribution codes are separated this way, because there are many possible combinations of any 2 codes. . 1099-R Box 7 has code 1B. There is no option 1B. There is an option 1 or B on the first pull down. The second pull down is only 1-5. distributed. 1099-R Box 7: Distribution Code(s) This box identifies the distribution code and tells the IRS the type of distribution taken by the taxpayer. The type of distribution matters because it helps to identify whether the money from the distribution is taxable or non-taxable. If the distribution was taken as a loan or roller, for example, the . On my 1099-R, I have code G in box 7 AND an amount equal to the gross distribution (line 1) inserted in line 2a. The Payer assures me the distribution was made to a qualified plan. I strongly believe this is a non-taxable yet Turbo Tax is treating the data I entered with a full tax hit.

Codes 1 and M are separate codes in the same box 7 and each code must be selected separately in the two box-7 drop-down boxes of TurboTax's 1099-R form. The code 1 on each of the forms indicates that each of these distributions is subject to a 10% early-distribution penalty unless rolled over to another retirement account or you have a penalty .When entering the Distribution Code in Box 7, if the Code is a 3, the 10% Additional Tax for Early Withdrawal does not apply and no further action is necessary upon exiting this 1099-R menu. However, when the Distribution Code in Box 7 is a 1 or 2, the program will prompt you to select which part of Form 5329 the distribution should transfer to.A 1099-R from the 401k provider, for the rollover out of the 401k. Usually it would list distribution code 1 (if rollover was indirect) or code G (if rollover was direct) A 1099-R from the traditional IRA provider, for the conversion out of the traditional IRA. It would list distribution code 2 .

cnc horizontal boring machine quotes

1099-R Form Retirement Distribution Codes. The Distribution Code Table below refers to the entries on Form 1099 in Box 7. Detailed overview, instructions of Form 1099-R and 5498. Instructions on how to enter Form 1099-R on your tax return What do the codes in the distribution code(s) box of Form 1099-R mean? Code Meaning; 1: Early distribution, no known exception, for taxpayers under age 59 ½. 2: Early distribution, exception applies, for taxpayers under age 59 ½. 3: Disability, for taxpayers avoiding early distribution penalties due to a disability. 4: Do any of the 1099-R's have "Corrected" marked at the top of the form? Is the 1099-R with code 7 in box 7 "corrected" by a subsequent 1099-R with code 2 in box 7? Are the numbers in box 1 the same on each form? Perhaps the 1099-R with code 7 was corrected by a 1099-R with code 2. In that case, the 1099-R with code 7 should be ignored.

I received a 1099-R from my TDAmeritrade and I found out that box 7 distribution code is 2 instead of 1. I have not filed my income tax yet; so how do I correct this. I did contract TDAmeritrade two times and both times they refused to do the correction. They said that I have to contact tax advis.

cnc horizontal boring machine manufacturers

At ProleanTech, our design engineers help to optimize your drawing according to the sheet metal design guidelines. So, we can streamline the fabrication process and reduce material waste and cost. Our sheet metal fabrication service includes bending, stamping, welding, punching, blanking, deep drawing, embossing, etc.

what is distribution code 2 in box 7 of 1099-r|1099 distribution code 7d