distribution code 2 in box 7 of 1099-r Code 2 is in box 7 of my 1099-R. What does "early distribution, exception applies" . This container is an aluminum box which provides environmental protection for one weapon-round and three BCUs during shipping and storage. It also contains one set of ear plugs.

0 · what does code 7d mean

1 · irs 1099 box 7 codes

2 · form 1099 box 7 codes

3 · distribution code 7 normal

4 · 1099r box 7 code 8

5 · 1099 r distribution code m2

6 · 1099 r distribution code e

7 · 1099 distribution code 7d

Electrical Boxes: Junction Box, Outlet Box, Single Gang, 2 Gang. Electrical Boxes vary in size, material, number of gangs, and shape and are designed for specific uses like junctions, outlets, and switch or fixture boxes for wiring in wall or ceiling. Use this guide to determine the best electrical box choice for your application.

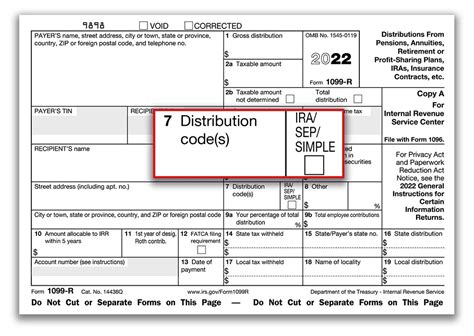

The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty.

Code 2 is in box 7 of my 1099-R. What does "early distribution, exception applies" .Use Code 2 only if the participant has not reached age 59½ and you know the . Code 2 is in box 7 of my 1099-R. What does "early distribution, exception applies" mean in the code explanation? I was 55 when I retired. Use Code 2 only if the participant has not reached age 59½ and you know the distribution is the following. - A Roth IRA conversion (an IRA converted to a Roth IRA). - A .

If a rollover contribution is made to a traditional or Roth IRA that is later revoked or closed, and distribution is made to the taxpayer, enter in boxes 1 and 2a of Form 1099-R the gross .

what does code 7d mean

irs 1099 box 7 codes

Use Code 2 only if the participant has not reached age 59 1/2 and you know the . Code 2, Early distribution, exception applies, lets the IRS know that the individual is under age 59½ but that he or she qualifies for certain exceptions. the individual qualifies for a penalty tax exception that doesn’t . This chart clearly identifies the distribution codes for Box 7 of form1099-R, which helps note the type of distribution you received, and what they all mean. Services; . (as .Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. Early distribution, no known exception (in most cases, .

Use Code 7 in box 7 for reporting military pensions or survivor benefit annuities. Use Code 4 for reporting death benefits paid to a survivor beneficiary on a separate Form 1099-R. Do not . Form 1099-R Distribution Codes from Box 7. Detailed explanation. The Distribution Code Table below refers to the entries on Form 1099 in Box 7. Detailed overview, instructions .The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty.

Code 2 is in box 7 of my 1099-R. What does "early distribution, exception applies" mean in the code explanation? I was 55 when I retired. Use Code 2 only if the participant has not reached age 59½ and you know the distribution is the following. - A Roth IRA conversion (an IRA converted to a Roth IRA). - A distribution made from a qualified retirement plan or IRA because of .

form 1099 box 7 codes

If a rollover contribution is made to a traditional or Roth IRA that is later revoked or closed, and distribution is made to the taxpayer, enter in boxes 1 and 2a of Form 1099-R the gross distribution and the appropriate code in box 7 (Code J for a Roth IRA).Use Code 2 only if the participant has not reached age 59 1/2 and you know the distribution is: A Roth IRA conversion (an IRA converted to a Roth IRA). A distribution made from a qualified retirement plan or IRA because of an IRS levy under section 6331.

Code 2, Early distribution, exception applies, lets the IRS know that the individual is under age 59½ but that he or she qualifies for certain exceptions. the individual qualifies for a penalty tax exception that doesn’t require using codes 1, 3, or 4. This chart clearly identifies the distribution codes for Box 7 of form1099-R, which helps note the type of distribution you received, and what they all mean. Services; . (as opposed to Code 8 with the distribution taxable the year of the 1099-R form). 1 (Early Distribution) 2 (Early Distribution—not subject to 10% early distribution tax) .Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. Early distribution, no known exception (in most cases, under age 59½). Early distribution, exception applies (under age 59½).Use Code 7 in box 7 for reporting military pensions or survivor benefit annuities. Use Code 4 for reporting death benefits paid to a survivor beneficiary on a separate Form 1099-R. Do not combine with any other codes. Governmental section 457(b) plans. Report on Form 1099-R, not Form W-2, income tax withholding and

tornos cnc inclinados

Form 1099-R Distribution Codes from Box 7. Detailed explanation. The Distribution Code Table below refers to the entries on Form 1099 in Box 7. Detailed overview, instructions of Form 1099-R and 5498. Participant has not reached age 59 1/2, and there are no known exceptions under Code 2, 3, or 4 apply.The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty. Code 2 is in box 7 of my 1099-R. What does "early distribution, exception applies" mean in the code explanation? I was 55 when I retired. Use Code 2 only if the participant has not reached age 59½ and you know the distribution is the following. - A Roth IRA conversion (an IRA converted to a Roth IRA). - A distribution made from a qualified retirement plan or IRA because of .

If a rollover contribution is made to a traditional or Roth IRA that is later revoked or closed, and distribution is made to the taxpayer, enter in boxes 1 and 2a of Form 1099-R the gross distribution and the appropriate code in box 7 (Code J for a Roth IRA).Use Code 2 only if the participant has not reached age 59 1/2 and you know the distribution is: A Roth IRA conversion (an IRA converted to a Roth IRA). A distribution made from a qualified retirement plan or IRA because of an IRS levy under section 6331. Code 2, Early distribution, exception applies, lets the IRS know that the individual is under age 59½ but that he or she qualifies for certain exceptions. the individual qualifies for a penalty tax exception that doesn’t require using codes 1, 3, or 4.

This chart clearly identifies the distribution codes for Box 7 of form1099-R, which helps note the type of distribution you received, and what they all mean. Services; . (as opposed to Code 8 with the distribution taxable the year of the 1099-R form). 1 (Early Distribution) 2 (Early Distribution—not subject to 10% early distribution tax) .Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. Early distribution, no known exception (in most cases, under age 59½). Early distribution, exception applies (under age 59½).

Use Code 7 in box 7 for reporting military pensions or survivor benefit annuities. Use Code 4 for reporting death benefits paid to a survivor beneficiary on a separate Form 1099-R. Do not combine with any other codes. Governmental section 457(b) plans. Report on Form 1099-R, not Form W-2, income tax withholding and

distribution code 7 normal

What is running through your neighborhood is a thick underground cable containing perhaps 25 or 50 pairs of copper wires. The little green box is a place where the 50-pair cable pops out of the ground so that a phone company employee can splice into it.

distribution code 2 in box 7 of 1099-r|1099r box 7 code 8