1099-r state distribution box 16 You should enter the full amount as the state distribution in box 16 when .

6-compartment Yumbox is perfect for young children (toddlers-age 8). It offers variety .

0 · is a 1099 r taxable

1 · irs 1099 r distribution codes

2 · irs 1099 r 2023

3 · internal revenue service 1099 r

4 · gross distribution on 1099 r

5 · 1099 r form pdf

6 · 1099 r boxes explained

7 · 1099 r box 16 blank

$70.00

If your Form 1099-R does not have an amount in box 16 for a state distribution, but there is an amount in box 14 for state tax withheld, then the review message thinks there should be something in box 16.

If your Form 1099-R does not have an amount in box 16 for a state distribution, .TurboTax is here to make the tax filing process as easy as possible. We're .

Find TurboTax help articles, Community discussions with other TurboTax users, .We would like to show you a description here but the site won’t allow us.

You should enter the full amount as the state distribution in box 16 when . If there is an entry in Boxes 14 or 15 on your 1099-R, TurboTax will expect an amount in Box 16. If Box 14 shows State Tax withheld, you can enter the amount from Box 2a. If no state tax was withheld, you can delete the State .If an IRA conversion contribution or a rollover from a qualified plan is made to a Roth IRA that is later revoked or closed, and a distribution is made to the taxpayer, enter the gross distribution . Since retirement income follows residency, you'll need to apply the law for the client's state of residency. And you'll have to determine if it qualifies as a disability retirement .

For distributions from a Roth IRA, generally the payer isn’t required to compute the taxable amount. You must compute any taxable amount on Form 8606. An amount shown in box 2a .

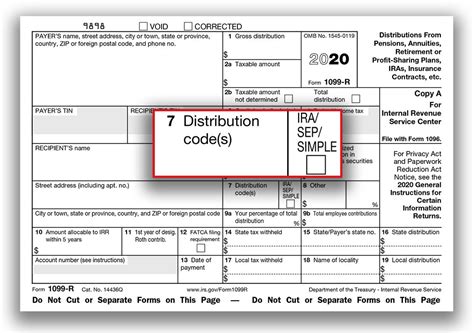

A 1099-R reports distributions from retirement accounts or other sources that may be taxable. Learn when you might get one, what information it contains and how to report it on your tax return. 1099-R Box 1: Gross Distribution. This box identifies the amount of distribution from a retirement plan or annuity. The number is identified in a gross dollar amount. There are many factors that will impact whether this amount is .To ease statement furnishing requirements, Copies B, C, D, 1, and 2 have been made fillable online in a PDF format available at IRS.gov/ Form1099R and IRS.gov/Form5498. You can .

You should enter the full amount as the state distribution in box 16 when entering your Form 1099-R since you do have state withholding. Use the federal taxable amount for .

If your Form 1099-R does not have an amount in box 16 for a state distribution, but there is an amount in box 14 for state tax withheld, then the review message thinks there should be something in box 16. If there is an entry in Boxes 14 or 15 on your 1099-R, TurboTax will expect an amount in Box 16. If Box 14 shows State Tax withheld, you can enter the amount from Box 2a. If no state tax was withheld, you can delete the State .If an IRA conversion contribution or a rollover from a qualified plan is made to a Roth IRA that is later revoked or closed, and a distribution is made to the taxpayer, enter the gross distribution in box 1 of Form 1099-R.Regarding 1099-R distribution codes, retirement account distributions on Form 1099-R, Code 4 are taxable based on the amounts in Box 2a. Include the federal withholding amount reported in Box 4 as an additional withholding.

His 1099-R shows a taxable distribution in box 1 and 2 for fed taxes. However, box 16 (state distribution) does not show an amount. Does that mean this pension/retirement income was not taxable at state level? What is a 1099-R? A 1099-R is an IRS information form that reports potentially taxable distributions from certain types of accounts, many of which are retirement savings accounts. You’ll generally receive one for distributions of or more. The plan or account custodian completing the 1099-R must fill out three copies of every 1099-R they . For most people, this gets used to report the distribution as income and include it on lines 4b and 5b of their Form 1040. This form’s considered an informational form which means it’s used by the IRS from the issuer to know what should get taxed. When you file your taxes, you’ll attach Copy B to your tax form.

small junction box for under cabinet lighting

Taxpayers who take retirement distributions may receive IRS Form 1099-R in the January following the calendar year of their distribution. However, this tax form serves many purposes besides simply reporting retirement benefits. In this article, we’ll walk through IRS Form 1099-R, including: Let’s start with a step by step look at IRS Form 1099-R. You should enter the full amount as the state distribution in box 16 when entering your Form 1099-R since you do have state withholding. Use the federal taxable amount for your state distribution amount. If Box 14 shows State Tax withheld, the Distribution Amount (Box 1) should be entered in Box 16. If no state tax was withheld, you can delete the State ID number , so that Boxes 14, 15 and 16 are blank.If your Form 1099-R does not have an amount in box 16 for a state distribution, but there is an amount in box 14 for state tax withheld, then the review message thinks there should be something in box 16.

If there is an entry in Boxes 14 or 15 on your 1099-R, TurboTax will expect an amount in Box 16. If Box 14 shows State Tax withheld, you can enter the amount from Box 2a. If no state tax was withheld, you can delete the State .If an IRA conversion contribution or a rollover from a qualified plan is made to a Roth IRA that is later revoked or closed, and a distribution is made to the taxpayer, enter the gross distribution in box 1 of Form 1099-R.Regarding 1099-R distribution codes, retirement account distributions on Form 1099-R, Code 4 are taxable based on the amounts in Box 2a. Include the federal withholding amount reported in Box 4 as an additional withholding.

His 1099-R shows a taxable distribution in box 1 and 2 for fed taxes. However, box 16 (state distribution) does not show an amount. Does that mean this pension/retirement income was not taxable at state level? What is a 1099-R? A 1099-R is an IRS information form that reports potentially taxable distributions from certain types of accounts, many of which are retirement savings accounts. You’ll generally receive one for distributions of or more. The plan or account custodian completing the 1099-R must fill out three copies of every 1099-R they . For most people, this gets used to report the distribution as income and include it on lines 4b and 5b of their Form 1040. This form’s considered an informational form which means it’s used by the IRS from the issuer to know what should get taxed. When you file your taxes, you’ll attach Copy B to your tax form.

Taxpayers who take retirement distributions may receive IRS Form 1099-R in the January following the calendar year of their distribution. However, this tax form serves many purposes besides simply reporting retirement benefits. In this article, we’ll walk through IRS Form 1099-R, including: Let’s start with a step by step look at IRS Form 1099-R. You should enter the full amount as the state distribution in box 16 when entering your Form 1099-R since you do have state withholding. Use the federal taxable amount for your state distribution amount.

is a 1099 r taxable

Buying an electric food storage lunch box is one way to ensure you can always keep your food fresh. They provide excellent storage capacity with quick heating capabilities. The three best options are the YISSVIC Electric Lunch Box, FORABEST Electric Lunch Box, and NICEPRO Bento Electric Lunch Box.

1099-r state distribution box 16|is a 1099 r taxable