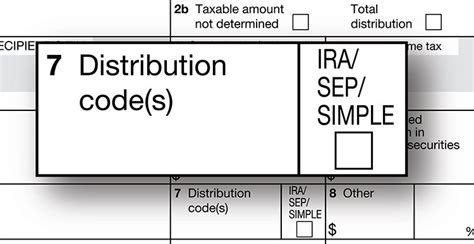

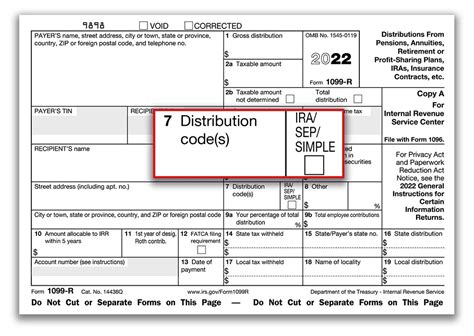

1099 box 7 distribution code 2 The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty. We manufacture a wide range of brass turned parts, including sensor parts, heat transfer parts, conductive parts, connectors, and more. We are equipped with state-of-the-art CNC lathes and automatic lathe processing facilities, which enable us to machine precision brass parts with tight tolerances and surface finishes to customer specifications.

0 · irs distribution code 7 meaning

1 · irs 1099 box 7 codes

2 · form 1099 box 7 codes

3 · distribution code 7 normal

4 · 1099 r distribution code meanings

5 · 1099 r distribution code 7m

6 · 1099 form distribution code 7

7 · 1099 box 7 code 1

CNCPros.com offers a wide variety of parts designed to fit your Fadal like Ballscrews, ATC clips, spindles, resolvers, amplifiers, inverters and more – all on-the-shelf, ready-to-ship today! Lowest prices on the things you really need.

The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty.Use Code 2 only if the participant has not reached age 59½ and you know the .Its not "normal" because you are not 59 1/2. Normal simply means 59 1/2. However, . Use Code 2 only if the participant has not reached age 59½ and you know the distribution is the following. - A Roth IRA conversion (an IRA converted to a Roth IRA). - A .

Its not "normal" because you are not 59 1/2. Normal simply means 59 1/2. However, Box 2 means you are not paying the 10% penalty either way. So, you are not penalized for not .

For distributions made after December 31, 2023, an emergency personal expense distribution may be made from a 403(b) plan and is not subject to the 10% additional tax on early . Use Code 2 only if the participant has not reached age 59 1/2 and you know the .

Code 2, Early distribution, exception applies, lets the IRS know that the individual is under age 59½ but that he or she qualifies for certain exceptions. the individual qualifies for a penalty tax exception that doesn’t . This chart clearly identifies the distribution codes for Box 7 of form1099-R, which helps note the type of distribution you received, and what they all mean. . (as opposed to .

irs distribution code 7 meaning

Are you filing a Form 1099-R for your client? Find the explanation for box 7 codes here. (1) Early distribution (taxpayer is under age 59-1/2) and there is no known exception to the early . You’ll receive an IRS Form 1099-R if you’ve received a distribution of at least from a retirement account, pension, annuity, or variety of other plans. Today’s post can be used as a reference when deciphering the code(s) .If a rollover contribution is made to a traditional or Roth IRA that is later revoked or closed, and distribution is made to the taxpayer, enter in boxes 1 and 2a of Form 1099-R the gross .

The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty.

Use Code 2 only if the participant has not reached age 59½ and you know the distribution is the following. - A Roth IRA conversion (an IRA converted to a Roth IRA). - A distribution made from a qualified retirement plan or IRA because of .

Its not "normal" because you are not 59 1/2. Normal simply means 59 1/2. However, Box 2 means you are not paying the 10% penalty either way. So, you are not penalized for not being 59 1/2 regardless. A "7' wouldn't be any better than a "2".For distributions made after December 31, 2023, an emergency personal expense distribution may be made from a 403(b) plan and is not subject to the 10% additional tax on early distributions.Use Code 2 only if the participant has not reached age 59 1/2 and you know the distribution is: A Roth IRA conversion (an IRA converted to a Roth IRA). A distribution made from a qualified retirement plan or IRA because of an IRS levy under section 6331. Code 2, Early distribution, exception applies, lets the IRS know that the individual is under age 59½ but that he or she qualifies for certain exceptions. the individual qualifies for a penalty tax exception that doesn’t require using codes 1, 3, or 4.

This chart clearly identifies the distribution codes for Box 7 of form1099-R, which helps note the type of distribution you received, and what they all mean. . (as opposed to Code 8 with the distribution taxable the year of the 1099-R form). 1 (Early Distribution) 2 (Early Distribution—not subject to 10% early distribution tax) 4 (Death) .Are you filing a Form 1099-R for your client? Find the explanation for box 7 codes here. (1) Early distribution (taxpayer is under age 59-1/2) and there is no known exception to the early distribution penalty. Generally file Form 5329, however for a rollover to a traditional IRA of the entire taxable part of the distribution, do not file Form 5329; You’ll receive an IRS Form 1099-R if you’ve received a distribution of at least from a retirement account, pension, annuity, or variety of other plans. Today’s post can be used as a reference when deciphering the code(s) found in Box 7, which is the distribution code(s) box of your Form 1099-R.If a rollover contribution is made to a traditional or Roth IRA that is later revoked or closed, and distribution is made to the taxpayer, enter in boxes 1 and 2a of Form 1099-R the gross distribution and the appropriate code in box 7 (Code J for a Roth IRA).

The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty. Use Code 2 only if the participant has not reached age 59½ and you know the distribution is the following. - A Roth IRA conversion (an IRA converted to a Roth IRA). - A distribution made from a qualified retirement plan or IRA because of . Its not "normal" because you are not 59 1/2. Normal simply means 59 1/2. However, Box 2 means you are not paying the 10% penalty either way. So, you are not penalized for not being 59 1/2 regardless. A "7' wouldn't be any better than a "2".For distributions made after December 31, 2023, an emergency personal expense distribution may be made from a 403(b) plan and is not subject to the 10% additional tax on early distributions.

Use Code 2 only if the participant has not reached age 59 1/2 and you know the distribution is: A Roth IRA conversion (an IRA converted to a Roth IRA). A distribution made from a qualified retirement plan or IRA because of an IRS levy under section 6331.

Code 2, Early distribution, exception applies, lets the IRS know that the individual is under age 59½ but that he or she qualifies for certain exceptions. the individual qualifies for a penalty tax exception that doesn’t require using codes 1, 3, or 4.

This chart clearly identifies the distribution codes for Box 7 of form1099-R, which helps note the type of distribution you received, and what they all mean. . (as opposed to Code 8 with the distribution taxable the year of the 1099-R form). 1 (Early Distribution) 2 (Early Distribution—not subject to 10% early distribution tax) 4 (Death) .Are you filing a Form 1099-R for your client? Find the explanation for box 7 codes here. (1) Early distribution (taxpayer is under age 59-1/2) and there is no known exception to the early distribution penalty. Generally file Form 5329, however for a rollover to a traditional IRA of the entire taxable part of the distribution, do not file Form 5329; You’ll receive an IRS Form 1099-R if you’ve received a distribution of at least from a retirement account, pension, annuity, or variety of other plans. Today’s post can be used as a reference when deciphering the code(s) found in Box 7, which is the distribution code(s) box of your Form 1099-R.

cutting out sheet metal with laser

d&d boxed sets of metal characters

Get high-quality CNC machined aluminum parts straight from the factory with Anebon. Our wholesale pricing ensures cost-effectiveness and precision engineering perfect for your project needs.

1099 box 7 distribution code 2|1099 form distribution code 7